About Ziapay App

Home > About Us

Company Profile

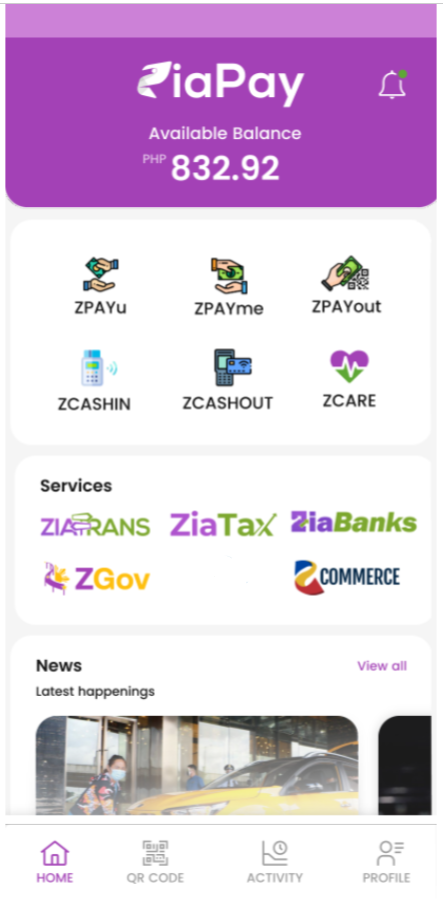

ZiaPay, Inc. aims to operate as an Electronic Money Issuer (EMI) to provide a secure and efficient electronic wallet facility that digitizes payments for government fees, retail payments, local remittances, collections of government fees, and disbursements of government assistance.

The e-wallet shall be funded through bank transfers, accredited cash-in outlets, and other authorized channels. Users may utilize their e-money balances to make payments to government agencies, settle bills, conduct merchant transactions, and perform peer-to-peer transfers. Cash-out facilities will be available through authorized agents and partner institutions.

Core Mission

The company’s core mission is to provide safe, efficient, and inclusive digital payment solutions that enable individuals and businesses ‒ especially the unbanked, underserved, and unserved ‒ to access affordable and reliable electronic money services. Our proposed services

- Electronic wallets, enabling cash-in, cash-out, domestic fund transfers, and merchant payments.

- Integration with government and private sector partners for collections, disbursements, and government-to-person (G2P) benefit programs

- Value-added services such as bill payments, remittances, and QR code–enabled merchant acceptance, in line with the National QR Ph standard.

- Efficiently redefine value-added internal sources without.

Objectives

Platform

We aim to provide a platform that supports the Department of Finance (DOF) With the Bank Sentral ng Pilipinas (BSP), Bureau of Treasury (BTR), Bureau of Internal Revenue (BIR) and Anti-Red Tape Authority (ARTA) implements the Ease-of-doing-business (EODB).

Security

To preserve authenticity on the name of the Business by the Business Name Registration System (BNRS) and its e-Resibo accredited by the BIR for the business to become legitimate rather than underground economy.

Compliance

To have BSP, Anti-Money Laundering Act (AMLA) Compliance and Know-your-customer (KYC) through the facial recognition, biometrics, optical character recognition (OCR), 2 Valid IDs and One-time-password (OTP).

E-Wallet

Products and Services

Electronic Money Services

- E-wallet features

- Loading and cash-out options

- Merchant payments

- Peer-to-peer transfers

Financial Services

- Bills payment

- Remittance

- Card services

- QR Ph services